Take charge of tomorrow. Trustmark Life + Care is an easy-to-administer life and care solution that provides the flexibility today’s policyholders need:

- Options for both professional and family care benefits; policyholders can move freely between the two1

- Guaranteed issue, guaranteed premiums and guaranteed benefits provide an added measure of stability

- A range of optional features including Death Benefit Restoration and Extension of Care Benefits

- Death Benefit Restoration – Maintains the death benefit if it’s used to pay for care

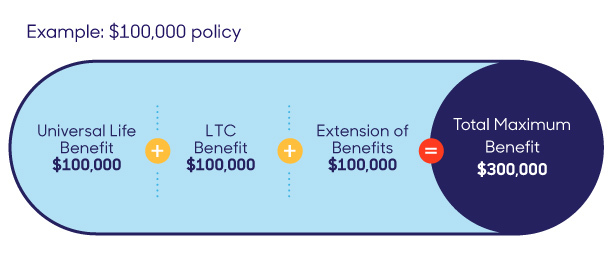

- Extension of Care Benefits – Doubles the amount of available care benefits