- Heart attack

- Cancer

- Stroke

Voluntary Benefits

Voluntary Benefits

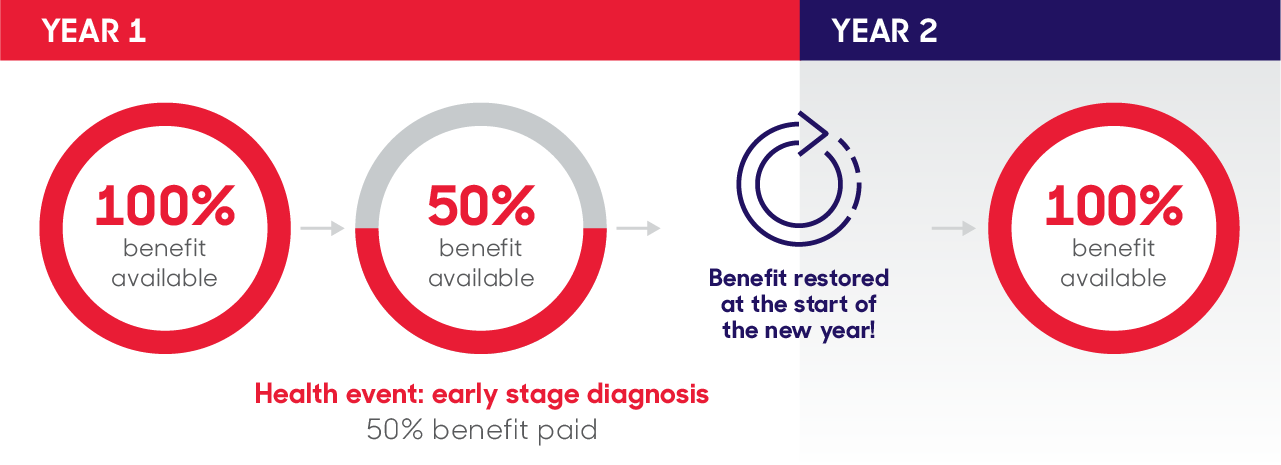

Available on both a group and individual basis, Trustmark Critical HealthEvents® is critical illness insurance that says “yes” more.

Illnesses can progress through many stages, which is why policyholders need protection at every step along the way:

*Only available on Trustmark Critical HealthEvents - Group

Offering voluntary benefits like Critical HealthEvents goes beyond the insurance coverage, it’s about creating a better workplace. Voluntary benefits can help:

Looking to purchase coverage for yourself or a family member? Get started here to let your employer know you're interested - Trustmark voluntary benefits are only available through work.

Benefits, definitions, exclusions and limitations may vary by state.

Trustmark and Trustmark Critical HealthEvents are registered trademarks of Trustmark Insurance Company.

Trustmark Voluntary Benefit Solutions, Inc. is a subsidiary of Trustmark Mutual Holding Company. Insurance products are underwritten by Trustmark Insurance Company or, for life insurance products in NY, Trustmark Life Insurance Company of New York.