Small Business Benefits

How Reference-Based Pricing Can Help Employers Fight Rising Health Costs

Published by Trustmark Small Business Benefits on August 20th, 2025

Health insurance renewals premiums aren’t just rising... they’re accelerating.

For small employers especially, traditional PPO plans are becoming harder to afford, harder to explain, and harder to control.Reference-Based Pricing (RBP) is emerging as a practical strategy to counter those unsustainable increases – offering employers more visibility into their healthcare spend and more power to shape it. That’s where RBP offers more than just savings. It delivers clarity and control. Plan reimbursements are tied to an objective standard – often more generous in terms of provider access.

If you’ve already introduced the concept of RBP to clients, the next step is helping them understand how it can help save money, and what makes it work in the real world.

Quick Recap: What Is Reference-Based Pricing?

RBP replaces the traditional PPO “discounted charges” model with a fair, reference-based payment. Usually tied to a percentage above Medicare’s allowable rates. It improves plan transparency, and can result in up to 30% premium savings*.With a consistent pricing benchmark in place, employers can regain control and start seeing real savings. If you're looking for a foundational breakdown of how RBP works and how it compares to PPOs, check out our blog post: Reference-Based Pricing vs. PPOs: What Small Employers Should Know.

Sustainability and Results

One of the many ways employers can save with level-funded solutions is through a refund or admin fee credit. Healthy ChoicesSM RBP plans are, on average, 20% more likely to receive a refund or admin fee credit at the end of the benefit period compared to network-based plans**.Healthy Choices RBP plans’ paid claim experience shows more than 5% lower trend compared to network-based plans**. Lower trend means lower premiums – and a better renewal rate. Healthy Choices RBP plans are on average 15% more likely to renew their plans with Trustmark®**.

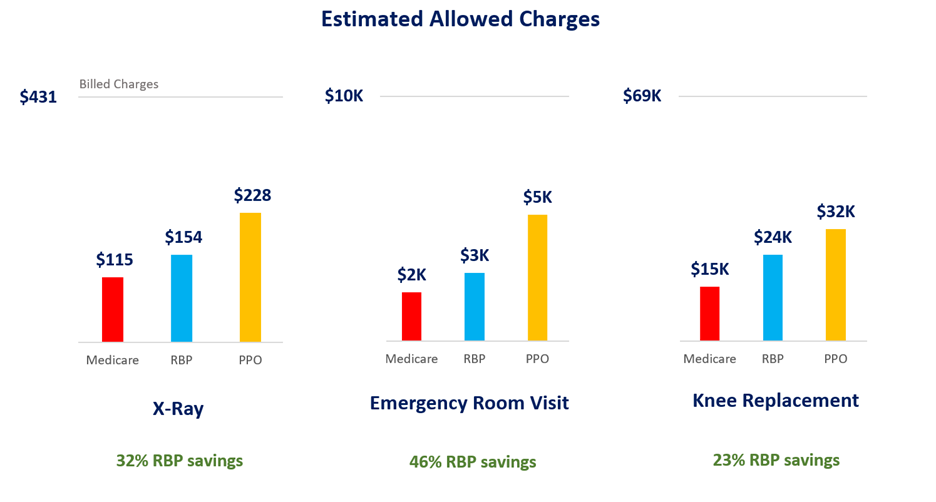

RBP in Action: Cost Comparisons That Tell the Story

Unlike conceptual comparisons, numbers often resonate more with business owners. Here’s how RBP stacks up against PPO pricing on a sampling of services**:

For a 50-life group, these differences scale fast – potentially saving six figures in one plan year. In addition to substantial premium savings, members may also benefit from lower out-of-pocket costs. For instance, when comparing the average costs for an emergency room visit – the RBP allowable is over $2000 less than the average PPO allowable charge, potentially savings members thousands, allowing members to retain more of their healthcare budget while ensuring access to necessary services.

Addressing Concerns: What About Balance Billing?

Yes, balance billing can happen under RBP. But modern RBP administrators have built-in protections that can help make it manageable:- Provider outreach: Successful RBP solutions actively work with providers to educate them or establish pre-negotiated rates.

- Member concierge: The most effective RBP options offer employees step-by-step support so they’re never left handling it alone.

Trustmark’s Balance bill protection ensures members are not responsible for balance bills***. Our resolution process is stress-free and fast – resolution occurs after the first balance bill is reported. Average balance bill resolution takes three business days or less, with 90% resolved in two business days or less.

Our Trusted Member Care support team is there to help with balance bills or any other issue. Our dedicated, knowledgeable in-house specialists provide personalized support to help members navigate their benefits with confidence.

Broker Talking Points That Stick

Use examples like these concise lines during presentations to help small to mid-sized employers see the value of switching:- “You’re not just getting a cheaper plan – you’re gaining control of your premium/cost.”

- Positions RBP as a strategic upgrade, not just a cost play.

- “RBP helps take the mystery out of medical pricing.”

- Emphasizes transparency and simplicity in plan design.

- “This strategy helps lower costs today – and five years from now.”

- Highlights long-term sustainability beyond first-year savings.

- “You can save up to 30% in premium without cutting coverage – or shifting more cost to your team.”

- Reinforces that savings don’t come at the expense of employees.

- “We’ll support your employees every step of the way – especially if balance billing issues arise.”

- Reassures employers that balance billing concerns are covered – and with Trustmark Healthy Choices, they are.

Healthy Choices: A Practical RBP Solution for Small to Mid-Sized Employers

Incorporating Healthy Choices into your benefits strategy can enhance your group’s experience. This product is designed to offer employers a tailored RBP solution that maximizes savings while ensuring employee satisfaction.- Customizable Plans: Healthy Choices allows employers to choose the best options that fit their workforce needs.

- Enhanced Support: With dedicated Trusted Member Care, employees can navigate their healthcare choices confidently.

- Proven Savings: Many clients using Healthy Choices experience significant savings on their healthcare costs.

RBP as a Strategy, Not Just a Switch

RBP works best when it’s part of a larger benefits strategy. The key is customizing the solution to the group’s comfort level, market dynamics, and workforce engagement.The Bottom Line: RBP Is Built for What Employers Need Right Now

As healthcare costs continue to rise, small to mid-sized businesses need better tools to manage what’s quickly becoming one of their largest expenses.RBP gives them that toolset – with real data behind the savings, a better member experience than they might expect, and a clearer path forward. For brokers, it’s a chance to bring clients a solution.

Now is the time to start the conversation – before another renewal season locks in higher costs.

Want to learn more about how RBP works in practice?

Watch the recording of our recent webinar, "From resistance to results: The new era of reference-based pricing," hosted by Thomas Coffey. See how to position RBP as a smart, strategic solution for your clients.

Watch the recording

* Trustmark Healthy Choices RBP premium savings relative to comparable network-based plans

** Trustmark Healthy Choices RBP historical experience, compared to network-based plans

*** Balance bill protection applies to covered eligible charges; additional member responsibility may apply for CDHP plans prior to deductible being met due to federal regulation.