Voluntary Benefits

Published by Trustmark Voluntary Benefits on October 21st, 2020

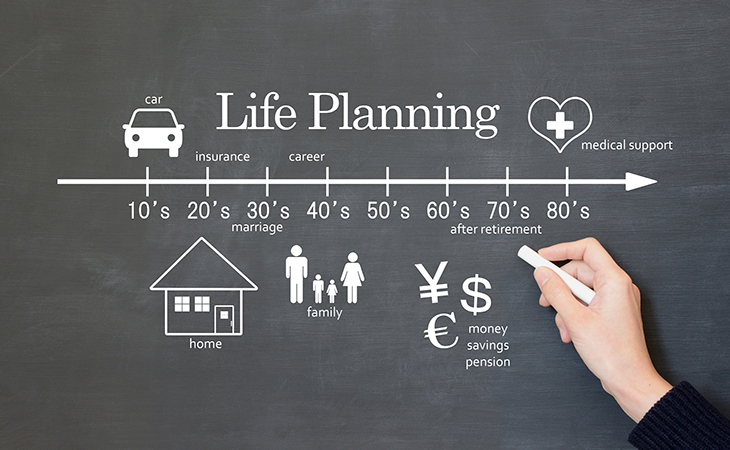

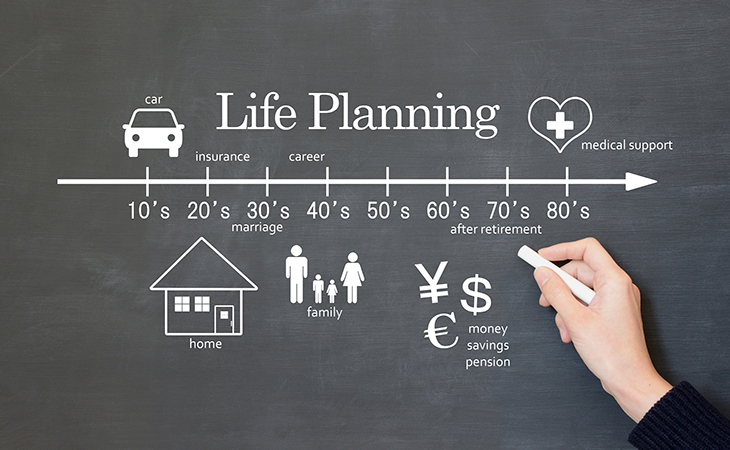

If you’re like most people, you probably view insurance as financial protection from unexpected events such as serious illness, accidents, fires and storm damage. However, especially in the world of voluntary benefits, there are many ways you can use insurance for life events that you do expect. Let’s take a look at a few examples of how you can use voluntary benefits to prepare yourself and your family for the things you’re already expecting.

Maternity

Hospitals are usually a hub for the unexpected, but there are a few situations where a hospital visit is long anticipated – like when you’re having a baby. If hospital insurance is available to you, it is a great benefit to consider if you plan to start a family soon. If you’re newly married or have been thinking about starting a family within the next few years, hospital insurance can help protect your finances from the costly medical bills associated with child birth and the associated hospital stay. It’s important to note that, depending on your insurance carrier, you may not be able purchase hospital insurance if you are already pregnant.

Aging and long-term care

We can all safely predict that we’re going to age. Did you know that 70 percent of people over the age of 65 will require long-term care?1 Whether you’re a young adult, middle aged or reaching retirement, there is a good chance that you’ll require some type of living assistance as you get older. That’s why it’s important to explore your long-term care options, even if you’re still young. You might be thinking, “I’m in my early adulthood and am very healthy, I don’t need to worry about long-term care insurance right now.” In reality, 40 percent of people currently receiving long-term care are between the ages of 18 and 46.1 While options for long-term care insurance have been shrinking, there are still opportunities to take advantage of with a universal life with long-term care policy. Plus, since rates are partially based on your age, you could get coverage now at a much lower cost; and if you have the right policy your rates won’t increase as you age.

Protecting your loved ones after you’re gone

Speaking of life insurance; it can help you financially prepare for the inevitable. Regardless of your age, the end of your life may seem like a long way off, but even if you are younger, you still need life insurance. As with long-term care, the older you are, the higher you should expect your costs for a policy; so the earlier you buy the better. Also, life insurance is particularly important if you have a younger family. Should something happen to you, a life insurance policy can help carry your partner and children through the years where they will need financial protection the most.

Nobody wants to think about their funeral, but it’s important to plan for nonetheless. If you aren’t properly prepared, the financial costs often fall on your loved ones during an already difficult time. Life insurance can help relieve some of this stress by helping cover funeral costs, which can run up to nearly $10,000.2

Wellness benefits

Whether you’re a healthy person or have your physician on speed dial, you probably expect to visit the doctor at least a couple times a year for check-ups, vaccinations, medication refills, etc… Some voluntary benefits like hospital insurance, critical illness or accident insurance may offer benefits for general wellness visits. This type of benefit helps:

1. Provide an incentive for you and your family to see a doctor regularly and stay healthy.

2. Offer you additional coverage for the doctor’s visits you would have planned anyway.

If you’re visiting the doctor anyway, and the option is available, why not take advantage of a benefit that pays you for those visits?

Life’s surprises can quickly impact your wallet; luckily, in these situations, the costs are more predictable. To make the best voluntary benefit choices for you and your family, be sure to have a detailed discussion with your partner or anyone that may be involved in your future. These types of conversations can help expand your perspective on voluntary benefits as a way to not only shelter your finances, but to plan for your financial future.

1Life Happens. Startling Facts about Long-Term Care. 2015.

2Statistics: Costs. National Funeral Directors Association. 2018.

Maternity

Hospitals are usually a hub for the unexpected, but there are a few situations where a hospital visit is long anticipated – like when you’re having a baby. If hospital insurance is available to you, it is a great benefit to consider if you plan to start a family soon. If you’re newly married or have been thinking about starting a family within the next few years, hospital insurance can help protect your finances from the costly medical bills associated with child birth and the associated hospital stay. It’s important to note that, depending on your insurance carrier, you may not be able purchase hospital insurance if you are already pregnant.

Aging and long-term care

We can all safely predict that we’re going to age. Did you know that 70 percent of people over the age of 65 will require long-term care?1 Whether you’re a young adult, middle aged or reaching retirement, there is a good chance that you’ll require some type of living assistance as you get older. That’s why it’s important to explore your long-term care options, even if you’re still young. You might be thinking, “I’m in my early adulthood and am very healthy, I don’t need to worry about long-term care insurance right now.” In reality, 40 percent of people currently receiving long-term care are between the ages of 18 and 46.1 While options for long-term care insurance have been shrinking, there are still opportunities to take advantage of with a universal life with long-term care policy. Plus, since rates are partially based on your age, you could get coverage now at a much lower cost; and if you have the right policy your rates won’t increase as you age.

Protecting your loved ones after you’re gone

Speaking of life insurance; it can help you financially prepare for the inevitable. Regardless of your age, the end of your life may seem like a long way off, but even if you are younger, you still need life insurance. As with long-term care, the older you are, the higher you should expect your costs for a policy; so the earlier you buy the better. Also, life insurance is particularly important if you have a younger family. Should something happen to you, a life insurance policy can help carry your partner and children through the years where they will need financial protection the most.

Nobody wants to think about their funeral, but it’s important to plan for nonetheless. If you aren’t properly prepared, the financial costs often fall on your loved ones during an already difficult time. Life insurance can help relieve some of this stress by helping cover funeral costs, which can run up to nearly $10,000.2

Wellness benefits

Whether you’re a healthy person or have your physician on speed dial, you probably expect to visit the doctor at least a couple times a year for check-ups, vaccinations, medication refills, etc… Some voluntary benefits like hospital insurance, critical illness or accident insurance may offer benefits for general wellness visits. This type of benefit helps:

1. Provide an incentive for you and your family to see a doctor regularly and stay healthy.

2. Offer you additional coverage for the doctor’s visits you would have planned anyway.

If you’re visiting the doctor anyway, and the option is available, why not take advantage of a benefit that pays you for those visits?

Life’s surprises can quickly impact your wallet; luckily, in these situations, the costs are more predictable. To make the best voluntary benefit choices for you and your family, be sure to have a detailed discussion with your partner or anyone that may be involved in your future. These types of conversations can help expand your perspective on voluntary benefits as a way to not only shelter your finances, but to plan for your financial future.

1Life Happens. Startling Facts about Long-Term Care. 2015.

2Statistics: Costs. National Funeral Directors Association. 2018.