Trustmark Paycheck Protect is assurance for your lifestyle and the things you love to do.

Your passions, hobbies, friends and family – they’re how you live your life to its fullest. And your paycheck is what lets you enjoy all those things. Trustmark Paycheck Protect helps you maintain your active life by protecting the income that makes it possible. You insure your home, your car, your health – but what about your paycheck? What would it mean to go without it? Let’s explore Paycheck Protect:

- Get an in-depth look at how Trustmark Paycheck Protect can work with you.

- Watch Morgan’s story to see what Paycheck Protect could do for a family like yours.

- Get an idea of how important a regular paycheck can be for your busy and active life.

- Get answers to some of the questions you might have about Paycheck Protect.

A112-2440-home-0911

A Closer Look at Paycheck Protect

A promise to help safeguard the salary that powers your life.

You and your family want to keep living your best lives, doing all the things you enjoy doing. Trustmark Paycheck Protect can help make sure that’s possible. After all, living the way that you want to depends on having a steady income. That’s where Paycheck Protect comes in.

Getting sick or hurt might take you off the job for a while. That could put your wages on hold too, and your lifestyle could take a real hit. But with Paycheck Protect, if a covered injury or illness means you can’t work, we’ll step in to help. We’ll pay you a percentage of your paycheck to help you and your family keep on going the way you all want to.

Peace of mind for your livelihood, lifestyle and livability – that’s Trustmark Paycheck Protect.

Getting sick or hurt might take you off the job for a while. That could put your wages on hold too, and your lifestyle could take a real hit. But with Paycheck Protect, if a covered injury or illness means you can’t work, we’ll step in to help. We’ll pay you a percentage of your paycheck to help you and your family keep on going the way you all want to.

Peace of mind for your livelihood, lifestyle and livability – that’s Trustmark Paycheck Protect.

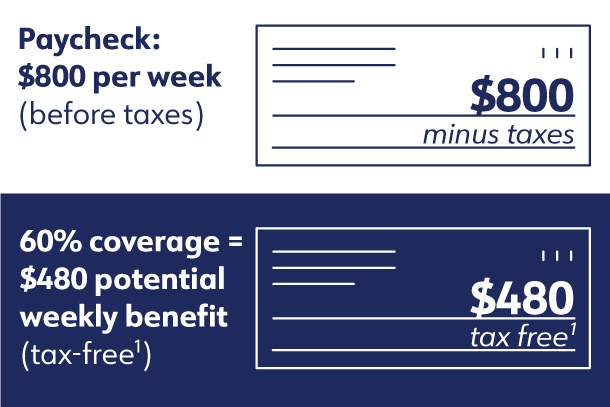

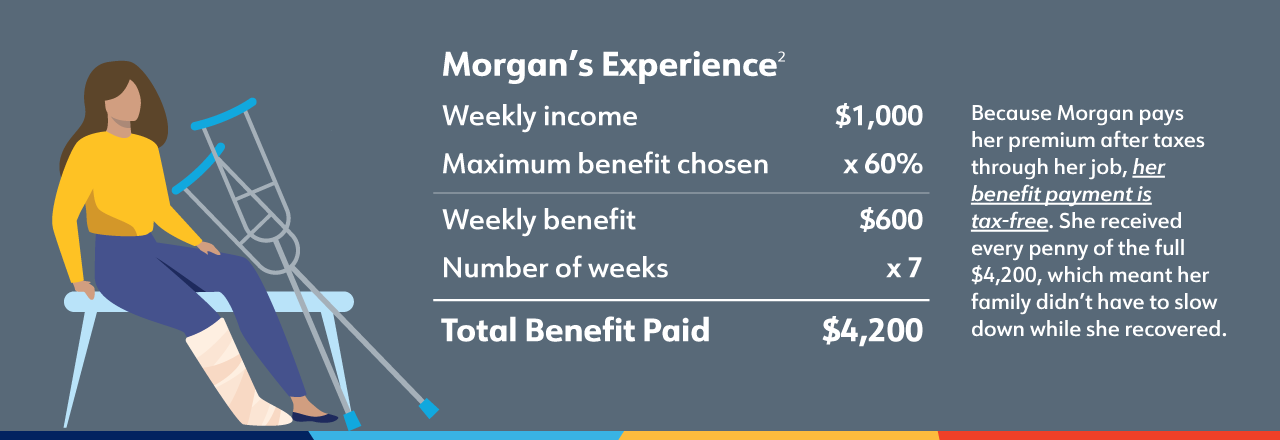

Here’s an in-depth example of how Paycheck Protect works:

With Paycheck Protect, you start getting paid after an elimination period (if any), and you’ll keep getting paid until either a.) you return to work from total disability or b.) the maximum benefit period ends. Your maximum benefit period (how long you can get paid) depends on your policy.Your benefits are paid directly to you. You get your full benefit even if medical insurance covers any or all of your bills. The money is yours, and you can use it for whatever you want or need, just like your ordinary paycheck. So you can focus on what’s important – your life and recovery – with less worry about how to pay for it all.

A112-2440-how-0911

Paycheck Protect: A Trustmark Story

Sample payment only. Coverage amounts may differ. Your policy will contain complete details.

A112-2440-story-0911

How much coverage might you need?

Did you know that 78% of Americans live paycheck to paycheck?1 Even with a few months’ savings, losing your paycheck could disrupt the life you’re used to. Click below to see some of the most common things you might use your paycheck for, and consider how Paycheck Protect may help you keep your active lifestyle going if you’re ever unable to work.

In most cases, you can elect a monthly Paycheck Protect benefit of up to 60% of your monthly salary, up to certain limits.

In most cases, you can elect a monthly Paycheck Protect benefit of up to 60% of your monthly salary, up to certain limits.

1Source: PayrollOrg 2024.

A112-2440-explore-0911

Frequently asked questions

A112-2440-faq-0911

Trustmark® and Trustmark Paycheck Protect® are registered trademarks of Trustmark Insurance Company.View disclosures, exclusions and limitations that may apply.