Raj

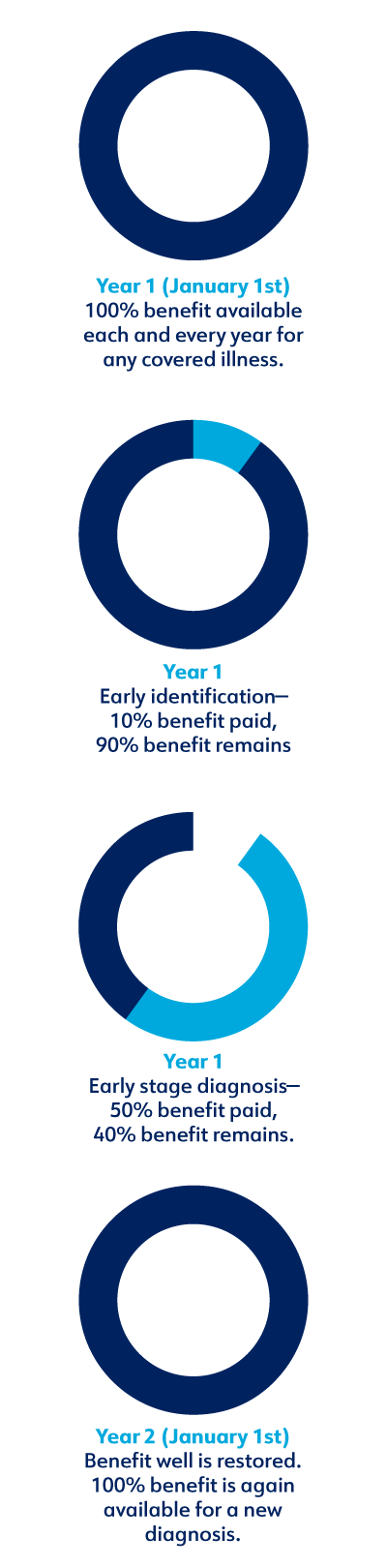

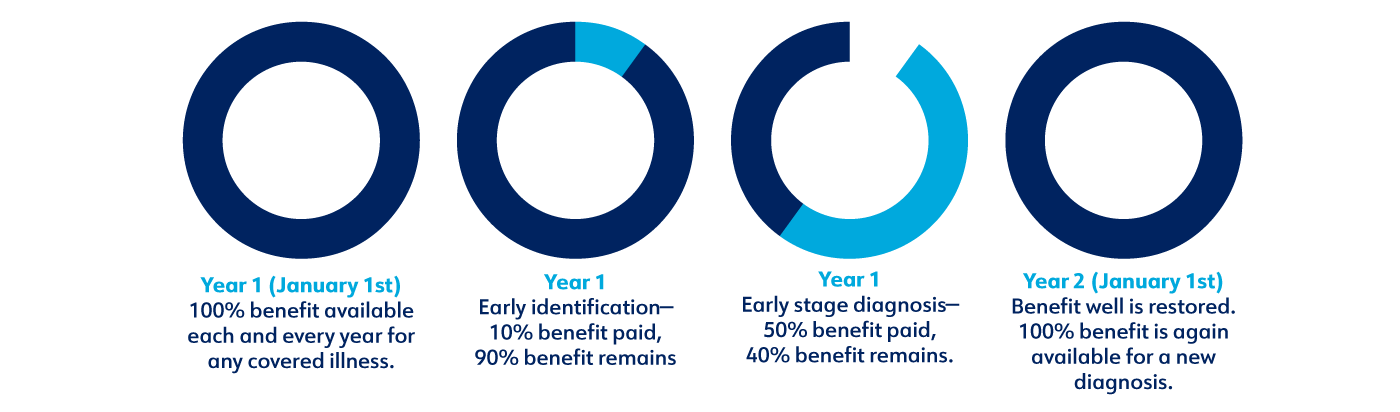

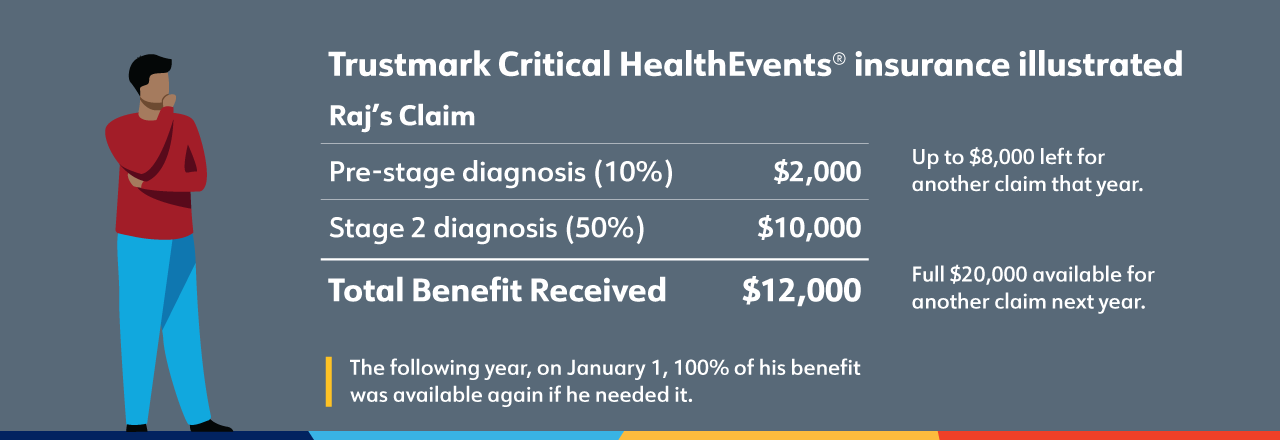

Let’s take a look at what a claim like Raj’s might look like.Raj’s policy has a $20,000 annual maximum. He was diagnosed with cancer before it staged, which paid 10% of that annual maximum. Later that same year, he was diagnosed with stage 2 cancer, which paid 50% of his annual maximum. If he had another claim, he would have had 40% of his annual maximum left to pay for that.