Trustmark Universal Life/LifeEvents® Insurance with Convalescent Care Benefit plus YourCare360® Care Planning Services

This program offers added financial protection for you and/or your spouse/certified domestic partner along with access to caregiving tools. No matter your age, now is the time to plan for life insurance and convalescent care. Call with questions or enroll based on your member group or scroll for more details.

Policy Details:

- The policy is designed to last the lifetime of the insured and build case value so you can help pay for college or live your retirement dreams.

- In-service members can purchase coverage for their qualifying spouse/certified domestic partner along with their children and grandchildren.

- You own your own coverage, and it is guaranteed renewable even if your health changes.

- Coverage is portable and cannot be terminated due to career changes, union status or place of residence.

- Waiver of premium option available. Monthly deductions are waived while the insured is totally disabled as determined by their doctor.

All About Trustmark Universal Life/LifeEvents® Insurance Features

Policy Details

In-Service Members: Ages 18-64 can enroll for up to $300,000 by answering medical questions.

Retirees: Coverage up to $100,000 up to age 70 with some health questions.

Death Benefit Options

Universal Life provides a consistent lifelong benefit, while the Universal LifeEvents® option offers a higher death benefit during your working years, when your needs and responsibilities are the greatest.

Build Cash Value

The policy is designed to last the lifetime of the insured and build cash value so you can help pay for college or live out your retirement dreams.

Coverage for Family

In-service members can purchase coverage for their qualifying spouse/certified domestic partner along with their children and grandchildren.

Permanent Life Insurance

You own your coverage, and it’s guaranteed renewable even if your health changes.

Portable

Coverage is portable and cannot be terminated due to career changes, union status or place of residence.

Optional Coverage

Waiver of premium option available. Monthly deductions are waived while the insured is totally disabled as determined by their doctor.Join a benefit specialist in a Universal Life Insurance Plus Convalescent Care* Educational Webinar session

In this webinar, you'll learn:

What long-term care is and about dispelling the long-term care myths

How insurance coverage helps protect your retirement plan for long-term care needs

How Trustmark Universal Life/Universal LifeEvents® Insurance with Convalescent Care Benefit helps secure your family’s financial future

Attend an On-Demand Webinar

*In New York, the long-term care benefit is the convalescent care benefit

How does the Convalescent Care Benefit Work?

The Convalescent Care benefit is an advance of the death benefit while you are living and can be used if you receive professional care.

The Convalescent Care benefit is triggered if you require assistance for severe cognitive impairment or need assistance with two of six daily living activities – bathing, dressing, using the toilet, transferring (to or from bed or chair), caring for continence and eating.

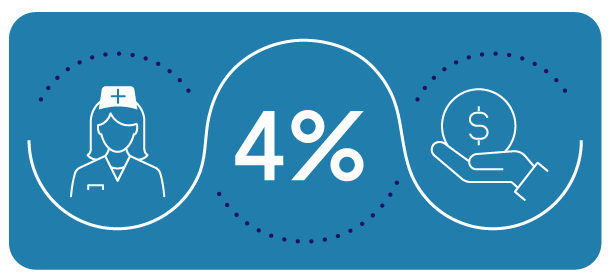

If you are RECEIVING care, after 90 days, 4% of your policy value is paid to you monthly (up to 25 months) that can be used to help pay for care expenses. In addition, the benefit is retroactive, so you will receive payment for the first 90 days as well.

Want to take a deep dive into the state of convalescent care? Read our white paper for more details.

View Universal Life/LifeEvents® product details

The Convalescent Care Benefit is an acceleration of the death benefit and is not Long-Term Care Insurance. It begins to pay after 90 days of confinement or services, and to qualify you must meet conditions of eligibility for benefits. Your policy will contain complete details.

Guiding You through the Caregiving Journey

YourCare360® Caregiving tools offer you and your family guidance in managing Convalescent Care needs.

Get more information about YourCare360

The Trustmark Difference

Have confidence with Trustmark Universal Life/LifeEvents® with Convalescent Care

Trustmark’s history is rooted in union memberships. Trustmark was founded in 1913 as the Brotherhood of All Railway Employees and later adopted the name Benefit Association of Railway Employees. Today, Trustmark has grown into a new kind of benefits provider – a modern mutual organization that supports the future success of organizations and unions by continually evolving our benefits portfolio.

* An AM Best rating is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations.

* An AM Best rating is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations.

Frequently Asked Questions

The Trustmark Universal Life with Convalescent Care Benefit Insurance Program + YourCare360® Care Planning Services is a NYSUT Member Benefits Trust (Member Benefits)-endorsed program. Member Benefits has an endorsement arrangement of 6.5% of premium received for the first 12 months and 0.2% of renewal premium, with a guaranteed annual minimum amount of $100,000 for this program. All such payments to Member Benefits are used solely to defray the costs of administering its various programs and, where appropriate, to enhance them. Member Benefits acts as your advocate; please contact Member Benefits at 800-626-8101 if you experience a problem with any endorsed program.

Trustmark® and LifeEvents® are registered trademark of Trustmark Insurance Company. Underwriting conditions may vary and determine eligibility for the offer of insurance. For exclusions and limitations that may apply, visit www.trustmarksolutions.com/disclosures/UL. Universal life insurance underwritten by Trustmark Life Insurance Company of New York, Albany, New York. YourCare360® is not a Trustmark Insurance Company program, but is created and managed by ACSIA Partners, LLC. Additional details, terms and conditions regarding the YourCare360® program can be provided by ACSIA Partners.

Trustmark® and LifeEvents® are registered trademark of Trustmark Insurance Company. Underwriting conditions may vary and determine eligibility for the offer of insurance. For exclusions and limitations that may apply, visit www.trustmarksolutions.com/disclosures/UL. Universal life insurance underwritten by Trustmark Life Insurance Company of New York, Albany, New York. YourCare360® is not a Trustmark Insurance Company program, but is created and managed by ACSIA Partners, LLC. Additional details, terms and conditions regarding the YourCare360® program can be provided by ACSIA Partners.